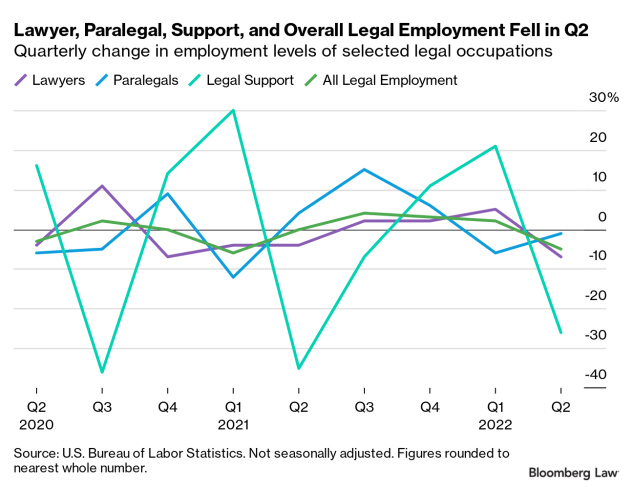

Legal employment had a rocky second quarter, despite generally strong US job growth, according to Bureau of Labor Statistics data. Legal employment levels contracted by 5.1% in Q2, from 1.89 million to 1.79 million, while the overall job market enjoyed its 18th straight month of expansion.

For the first time in the pandemic era, BLS reported quarterly employment losses in three major legal employment job classifications: From Q1 to Q2, lawyer employment contracted from 1.15 million to 1.07 million; paralegal employment dipped slightly from 452,000 to 449,000; and legal support employment shrunk from 88,000 to 65,000.

Legal employment for both men and women also fell in the second quarter from a quarterly average of 908,000 in Q1 to 840,000 in Q2 for menand from 984,000 in Q1 to 955,000 in Q2 for women.

The dip in employment numbers represent a trend reversal from the past three quarters, which saw a healthy recovery in legal employment, with numbers nearing pre-pandemic levels.

But as legal employment fell in Q2, the overall unemployment rate in the field fell from 1.7% to 1.4% between Q1 and Q2. This decline was propelled by unemployment rate decreases among paralegals (from 3.8% to 1.5%) and women in legal employment (from 2.7% to 1.6%).

The fall in both employment levels and unemployment rates in the legal field—while perhaps counterintuitive—indicates that although many legal professionals left their jobs (voluntarily or involuntarily), they have also left the legal job market altogether. However, quarter-over-quarter increases in the unemployment rates for lawyers (from 0.8% to 1%), legal support workers (from 2.2% to 3.6%), and men in legal employment (0.7% to 1.2%) show that many are still looking for employment in the field.

These lackluster quarterly figures may mean that macroeconomic factors that often correlate with a slowdown in economic activity such as high inflation, gross domestic product contraction, and increased labor costs are starting to affect the legal field more than other parts of the labor market. These factors may more acutely affect legal industry budgets and staffing because of the relatively high compensation in the field and the high costs associated with managing client relationships, as well as business factors such as fewer transactions due to the economic contraction.

It remains to be seen if this quarterly report is an anomaly or a reflection of a larger downturn in the legal field, but for now it appears that many in the legal field may face unwanted job market headwinds.

Bloomberg Law subscribers can find related content on our Legal Operations Practice Center and In Focus: Lawyer Development pages.

If you’re reading this on the Bloomberg Terminal, please run BLAW OUT